Zagreb, 2013

On 1st July 2013 Croatia becaùe a Member State of the European Union on 1st July 2013

Since then, the company register of Croatia can be found at BIZNET (http://www.biznet.hr/)

Public Search Europe - Company registers in Europe, USA and offshore.

Zagreb, 2013

On 1st July 2013 Croatia becaùe a Member State of the European Union on 1st July 2013

Since then, the company register of Croatia can be found at BIZNET (http://www.biznet.hr/)

Brussels - 2013- 2021 Since 2013, the offshore leak data base from the International Consortium of Investigative Journalists (ICIJ) is available to the general public.

The International Consortium of Investigative Journalists (ICIJ) is an independent network of journalists. It is based in Washington DC.

Have a look at International Consortium of Investigative Journalists (ICIJ) Database.

This ICIJ database contains information on more than 785,000 offshore entities that are part of the Panama Papers, the Offshore Leaks, the Bahamas Leaks and the Paradise Papers investigations. The data covers nearly 80 years up to 2016 and links to people and companies in more than 200 countries and territories.

It contains information on offshore companies in British Virgin Island, Cayman Islands, Hong Kong, Jersey, Singapore, ...

It includes offshore company directors based in Brussels (Uccle, Woluwé), Antwerpen, Waterloo, ...

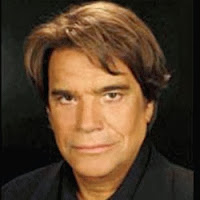

L'entrepreneur français, Bernard Tapie a créé en 2010 une société en Belgique, GBT Holding (BCE 0830.272.884, Avenue Delleur à Bruxelles) dans laquelle il a transféré 215 millions d'EUR par apport en nature.

Il s'agirait d'une partie du dédommagement perçu par B. Tapie pour la vente d'Addidas à la banque Credit Lyonnais, suite à la décision du Tribunal Arbitral en 2008.

GBT detient une participation dans une société de droit luxmbourgeois SREI South Real Estate Investment S.A. (B163453) qui serait propriétaire de sa résidence à Saint-Tropez

En 2018, le siége social de GBT est transféré dans la province de Liege, Rue Lieutenant Jungling à 4671 Blegny.

A la même adresse on trouve plusieurs sociétés liées à B. Tapie, dont

Ces sociétes sont dissoutes en décembre 2018 par décision judiciaire, et un liquidateur est nommé.

En mars 2021, des perquisitons ont lieu chez B. Tapie à Paris et à Saint-Tropez dans le cadre de cette affaire, à la demande des enquêteurs belges de l'office central de lutte contre la délinquance économique et financière organisée (OCDEFO) et un magistrat fédéral.

Sources :

.

Brussels -

"Banque carrefour" is the name of the official company register

This Blog is a private initiative not linked to the official governmental authorities

2012-2021